knoxville tn state sales tax rate

The base state sales tax rate in Tennessee is 7. Local collection fee is 1.

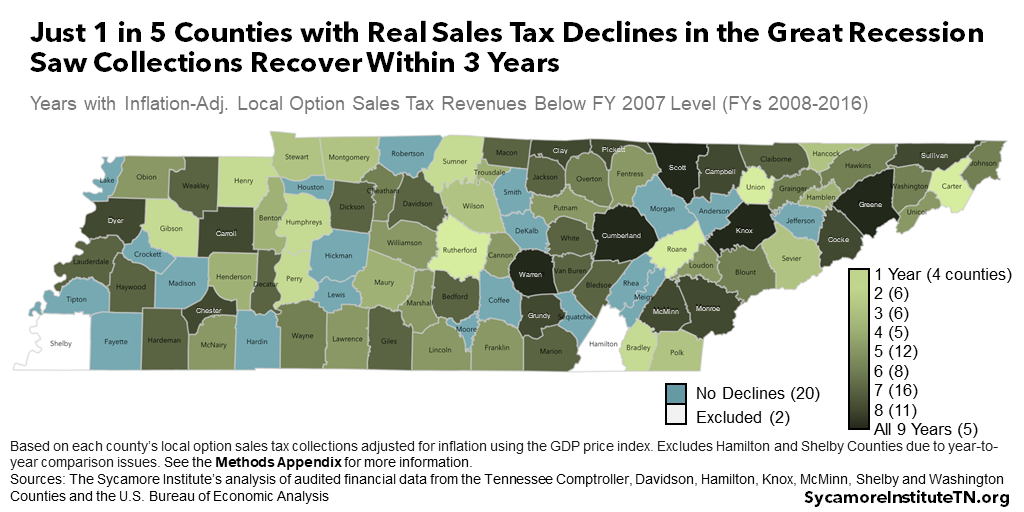

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

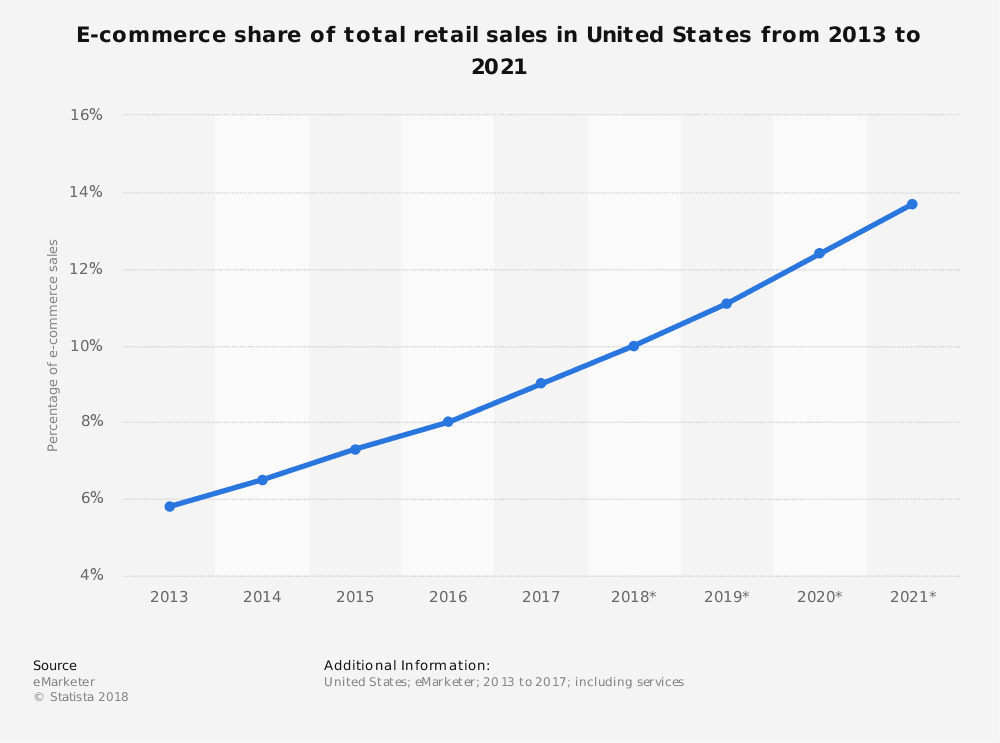

The 2018 United States Supreme Court decision in South Dakota v.

. Ad Automate Standardize Taxability on Sales and Purchase Transactions. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. 2022 List of Tennessee Local Sales Tax Rates.

The average combined tax rate is 946 ranking 1st in the US. 2020 rates included for use while preparing your income tax deduction. This rate includes any state county city and.

The Tennessee sales tax rate is 7 as of 2022 with some cities and counties adding a local sales tax on top of the TN state sales tax. Did South Dakota v. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property.

This includes the sales tax rates on the state county city and special levels. Tax Sale 10 Properties PDF. Knoxville TN Sales Tax Rate.

Purchases in excess of 1600 an additional state tax of 275 is added up to a. 9750 without affidavit of counseling. See reviews photos directions phone numbers and more for State Of Tennessee Sales Tax locations in Knoxville TN.

The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax. Average Sales Tax With Local. Rates include state county and city taxes.

The average cumulative sales tax rate in Knoxville Tennessee is 925. The Tennessee TN state sales tax rate is currently 7 ranking 2nd highest in the US. Exemptions to the Tennessee sales tax will vary by state.

Find your Tennessee combined state and local tax rate. The Tennessee state sales tax rate is currently. This amount is never to exceed 3600.

2022 Cost of Living Calculator for Taxes. YEARS IN BUSINESS. Has impacted many state nexus laws and sales tax.

This rate includes any state county city and local sales taxes. 05 lower than the maximum sales tax in TN. 212 per 100 assessed value.

There is no applicable city tax or special tax. 31 rows The latest sales tax rates for cities in Tennessee TN state. Local tax rates in Tennessee range from 0 to 3 making the sales tax range in Tennessee 7 to 10.

La Vergne TN Sales Tax Rate. 3750 with affidavit of counseling. Current Sales Tax Rate.

Maryville TN Sales Tax Rate. Knoxville TN 37901-5001 or in person at the downtown Property Tax Office. 2020 rates included for use while preparing your income tax deduction.

The latest sales tax rate for Knoxville TN. 24638 per 100 assessed value County Property Tax Rate. This is the total of state county and city sales tax rates.

The Knox County Sales Tax is collected by the merchant on all qualifying sales made within Knox County. This bid will NOT include the 2013 2014 or the 2015 taxes due to the City of Knoxville Tennessee or Knox County Tennessee. The minimum combined 2022 sales tax rate for Knox County Tennessee is.

Knoxville is located within Knox County Tennessee. The Tennessee sales tax rate is currently 7. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

Sales Tax State 700. To the City of Knoxville Tennessee and Knox County Tennessee. What is the sales tax rate in Knoxville Tennessee.

Tennessee has state sales tax of 7 and allows local governments to collect a local option sales tax of up to 275. Integrate Vertex seamlessly to the systems you already use. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales tax.

The Knoxville sales tax rate is 0. 925 7 state 225 local City Property Tax Rate. State Sales Tax is 7 of purchase price less total value of trade in.

Website Virtual Tour Directions More Info. Sales Tax Knoxville 225. Local Sales Tax is 225 of the first 1600.

Lebanon TN Sales Tax Rate. Local tax rates in Tennessee range from 0 to 3 making the sales tax range in Tennessee 7 to 10. You can print a 925 sales tax table here.

Tennessee sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Please click on the links to the left for more information. The minimum combined 2022 sales tax rate for Knoxville Tennessee is 925.

Depending on local municipalities the total tax rate can be as high as 10. The local tax rate varies by county andor city. Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code Anderson 275.

Taxes-Consultants Representatives Bookkeeping Accountants-Certified Public. This is the total of state and county sales tax rates. The Knox County Sales Tax is collected by the merchant on all qualifying sales made within Knox County.

Within Knoxville there are around 31 zip codes with the most populous zip code being 37918. Thus the sale of each property is made subject to these additional taxes. The sales tax rate does not vary based on zip code.

Local taxes apply to both intra-state and inter-state transactions. The County sales tax rate is 225. The sales tax is comprised of two parts a state portion and a local portion.

Knoxville Tennessee and Clarksville Tennessee. The average local rate is 246. City of Knoxville Revenue Office 865-215-2084.

Since penalty and interest continue to. Lowest sales tax 85 Highest sales tax 975 Tennessee Sales Tax. Knox County collects a 225 local sales tax the maximum local sales tax.

For tax rates in other cities see Tennessee sales taxes by city and county. The Knox County sales tax rate is. Johnson City 423 854-5321.

The general state tax rate is 7.

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Northeast Tn Counties See Huge Sales Tax Growth In Wake Of Internet Tax Law Wjhl Tri Cities News Weather

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

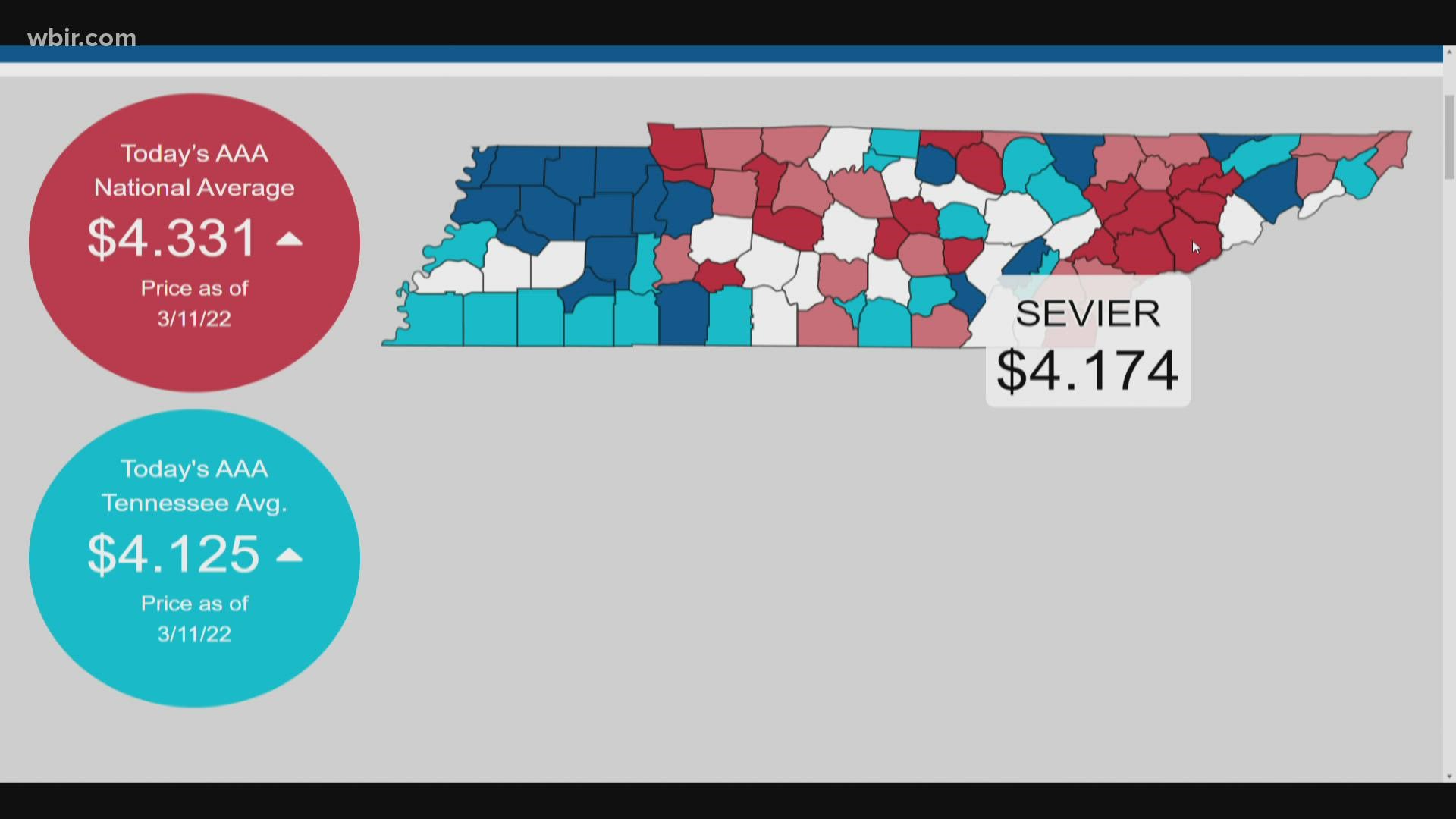

Gov Lee Has No Plans To Halt Tn S Gas Tax Amid Price Surge Wbir Com

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Tennessee Income Tax Calculator Smartasset

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Northeast Tn Counties See Huge Sales Tax Growth In Wake Of Internet Tax Law Wjhl Tri Cities News Weather

Northeast Tn Counties See Huge Sales Tax Growth In Wake Of Internet Tax Law Wjhl Tri Cities News Weather

Tennessee Sales Tax Rates By City County 2022

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

3 Things You Need To Know About Internet Sales Tax After Wayfair Red Stag Fulfillment